Do you want an Experienced Partner to Battle the IRS For You?

Our Tax Lawyers are proud of our BBB A+ Rating

Take the 59sec Tax Savings Calculator Now to Find Out:

Verified Client Results:

100% US-Based Staff

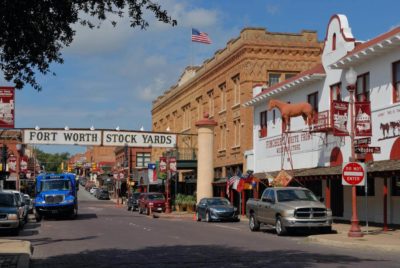

Proudly Serving Fort Worth, and All of Texas

Here's How the Process Works:

Free Initial Consultation and Financial Analysis

15 Minutes - We will go through your entire financial situation, step-by-step and see what programs you qualify for, determine how we can help, and answer any questions that you may have.

Research & Investigation

4-7 Days - Using the Power of Attorney, we will work with the IRS to determine what evidence they have against you (without disclosing anything), so we can create a plan of attack.

Fight for the Best Resolution

1-3 Months - After learning exactly what they have against you, we will negotiate with the IRS on your behalf, removing all the penalties we can, and fighting for a great settlement for you.

FREEDOM!

Forever - Once your tax burdens have been lifted, you can go on living your life again! You will finally be free of the burdens chasing you, and can start fresh with no tax debt!

Experienced IRS Tax Relief in Fort Worth

Highly Experienced Fort Worth Tax Lawyer

Everyone deserves to be free. Everyone deserves a right to dream and pursue such dream till it is achieved. But in the case of tax debts, dreams become blurry, shocking reality sets in and whatever freedom remains is never genuine.

Have you lost the courage to dream because you owe so much in back taxes that you can’t figure out how to be free? Do you live in the city of Fort Worth, TX and need help on getting rid of your tax debts? Debts you owe to the IRS (federal government) and may be to the state of Texas too, then, you need to call us today.

We are a leading team of experienced tax professionals comprising of seasoned tax attorneys, registered tax agents and Certified Public Accountants (CPAs).If you are really serious about getting rid of your tax debts, you need a team as skilled as ours that will be guiding you through the required process.

Our clients are no longer afraid of the IRS or any other tax body for that matter. They sleep comfortably now and enjoy their lives because we have got them covered. We have been able to get them the relief they deserve. We have even been able to negotiate a back tax reduction of up to ninety five percent (95 %) for a few of them. This way, they were only required to pay 5,000 Dollars even after having debts of 100,000 Dollars. The law has got an easy provision for such debtors, albeit with strict regulations.

Our Fort Worth attorney’s number is (713) 533-8299 . Please, call us today and take advantage of our free consultation service and we will be able to provide you with the relief that you deserve, the relief that suit your peculiar circumstances.

From experience, we have discovered that issues for which people regularly seek solutions from a tax professional include but are not limited to lifting of wage garnishments, bank levies and tax liens, understanding the tax notices and dealing with revenue staff who are always overbearing. We have been able to help clients with these issues and many more. We will be glad to help you too.

Give our office a call today!

Choose an Experienced Lawyer to Represent You

There has never been shortage of advertisements on tax lawyers, but you have to be very careful with your choice. Many of the adverts around are scams, especially those who fail to give proper consultation and claim to be capable of providing everyone with an offer in compromise, a form of tax relief to be discussed later. Run away from these scammers. You will definitely lose your hard earned money with them.

When choosing a tax company, a very important factor to be considered is the BBB (Better Business Bureau) rating of such company you are hiring. You can also get some third party reviews on the company. Most of the time, companies have good reputation and contain satisfactory reviews which, you can easily read from Trust pilot or iVouch. With information on the BBB rating and third party reviews of the company, whose service you are employing, you will be able to take sound decisions.

Why choose us?

While we are looking forward to working with you on your tax issues, the question about why you should choose us, remains valid. We are a team of tax professionals with decades of combined years of experience in tax issues. We have been able to provide several clients with the relief they deserve and in doing so, we have put an end mark in their struggles with debts. We have a sterling A+ BBB rating and we are ready to put our skills and experience in offering you a relief that suits you. Our long term relationship with the IRS and other tax bodies can put you at an advantaged position, where you will be able to negotiate the relief you deserve. With our professional appearance, you stand a better chance than any ‘normal’ customer of IRS.

Negotiating an Offer in Compromise

This is the relief with which few people have been able to save the largest amount. This is a type of relief that has allowed a handful of clients to save around 95 percent in terms of their dues to clear. Just like we mentioned earlier, this is guarded by strict regulations. You may just be qualified for an offer in compromise, especially if you are or have been suffering from difficult circumstances like bankruptcy, natural disaster etc. In such cases, we will just have to put forward an application that will enable us to negotiate with the IRS an amount you can feasibly and conveniently pay and you are on your way to the debt free future. However, if you are not qualified, there are a lot of other reliefs you can benefit from, most of which the IRS will not tell you about.

Getting Rid of Wage Garnishments

It is a common step of the government, through the IRS, to notify employers that they will now have to get a certain amount in terms of debts their employees have to pay to the state’s government. Of course, such employees will owe in both forms- as tax and other dues. Such amount deducted will be used to settle the amount employees owe as tax and additions to tax, until the debts are cleared. Sadly, when such decisions for deductions are made, you might not be present and therefore, no consideration may have been made for your individual circumstances. As a result, you may be left penniless with nothing to cater to your living expenses.

If this is your situation, you need to quickly take action in order to get the garnishment removed. Call us today and we can begin the process immediately. We will then negotiate a suitable relief for you- a relief worthy of being called one, considering your individual circumstances.

Penalty Abatement (getting them removed)

IRS gives penalties for different kinds of defaults. They do this in order to allow people to take prompt actions regarding filing their tax returns and paying their taxes in good time. Sometimes, these penalties can become so much that they make up a larger percentage of what you owe and occasionally, taxpayers get fined in error. However, you don’t have to worry, because we have always been able to get penalties removed totally and our clients are then able to pay the amount owed on some convenient arrangements.

Setting Up an Installment Agreement

Rather than being made to pay the amount owed all at once, we can help to negotiate a payment plan in which you will make regular and convenient payment on tax overtime. This way, you can settle your back taxes and still be left with enough to take care of your living expenses. Many taxpayers are taking advantage of this kind of arrangement and you too can have it. It may just be the relief you need to get out of debts.

Helping Out Businesses of All Sizes

For many reasons, taxpayers can owe so much on their businesses and IRS often takes possession of properties belonging to such businesses and depending on what type of business it is, they may be able to take possession of personal properties of the owner(s) of the business. Such properties include houses, lands, equipment and facilities and even bank accounts. All these personally owned properties are not only taken into possession but owners might have to lose some other assets as well. Do not lament so much if this is similar to your case. We get issues like this resolved every time. Your business can benefit from a suitable payment plan while you still have full possession of your properties.

Getting You Innocent Spouse Relief

Joint tax return, for married taxpayers, offers some advantages that make people to choose it. In some cases, both men and women become liable to pay the tax and additions to tax of such return even after they are divorced. Unless one of the parties involved file for an innocent spouse relief, both parties remain jointly and severally liable for the return. Just to be clear, this means that you will still be charged penalties and interests on the default of your erstwhile partner as long as you continue to operate such return. Call our experienced tax lawyers today and we can discuss in detail the conditions that qualify you for this relief, and if you are qualified we can negotiate it for you. After that, you can be free from penalties and debts you do not deserve by taking advantage of the relief you deserve.

As it has been said, we are a team of seasoned professionals poised to bring you the relief you deserve and help you get rid of your debts. You deserve to dream and dream bigger. You deserve a chance to live your dreams. You deserve to be happy. Give us a call and try our free consultation services at affordable rates. With our formidable team on your side, you will definitely have a genuine freedom while having a crystal clear of your future.

Other Cities Around Fort Worth We Serve

| Address | Fort Worth Instant Tax Attorney115 W 2nd St, Fort Worth, TX 76102 |

|---|---|

| Phone | (713) 533-8299 |

| Customer Rating | |

| Services / Problems Solved | Removing Wage GarnishmentsGetting Rid of Tax LiensRemoving Bank LeviesFiling Back Tax ReturnsStopping IRS LettersStopping Revenue OfficersSolving IRS Back Tax ProblemsIroning out Payroll Tax IssuesRelief from Past Tax IssuesNegotiating Offer in Compromise AgreementsNegotiating Innocent Spouse Relief ArrangementsPenalty Abatement NegotiationsAssessing Currently Not Collectible ClaimsReal Estate PlanningLegal Advice |

| Tax Lawyers on Staff | Steve Sherer, JD Kelly Gibson, JD Joseph Gibson, JD Lance Brown, JD |

| Cities Around Fort Worth We Serve | Addison, Aledo, Alvarado, Argyle, Arlington, Azle, Bedford, Boyd, Burleson, Carrollton, Cedar Hill, Cleburne, Colleyville, Coppell, Cresson, Crowley, Dallas, Decatur, Dennis, Denton, Desoto, Duncanville, Euless, Flower Mound, Fort Worth, Frisco, Godley, Granbury, Grand Prairie, Grandview, Grapevine, Haltom City, Haslet, Hurst, Hutchins, Irving, Joshua, Justin, Keene, Keller, Kennedale, Krum, Lake Dallas, Lancaster, Lewisville, Lillian, Little Elm, Mansfield, Maypearl, Midlothian, Millsap, Naval Air Station/ Jrb, Nemo, Newark, North Richland Hills, Paradise, Peaster, Ponder, Poolville, Red Oak, Rhome, Richardson, Rio Vista, Roanoke, Southlake, Springtown, The Colony, Venus, Waxahachie, Weatherford, Wilmer |